About me

My name is Dr. Rand Low, a quantitative finance professional based in Manhattan, New York.

I'm a Honorary Senior Research Fellow at the University of Queensland, Australia and a Chartered Professional Engineer (CPEng) in the Mechanical College of the Institution of Engineers, Australia.

I've travelled to ~45 countries and lived in 9 cities on 4 continents. I enjoy roadbiking, running and snowboarding. Artists I like listening to are Matchbox 20, James Bay, John Mayer, and Paolo Nutini.

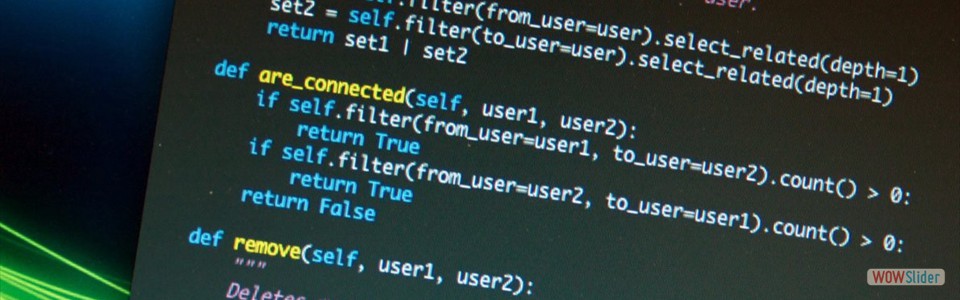

Why another Python coding blog?

The idea for this coding blog arose when I conducting a series of workshops entitled Python in Finance and Machine Learning at the UQ Business School in 2018. Using a website was the most expedient and efficient method to distribute the workshop materials.

After the workshop, several students contacted me regarding their desire to increase their skillsets and knowledge in quantitative finance. I had several conversations with senior professors and BEL faculty members whom expressed the challenges of bridging the gap between the skills needed to be successful in the finance industry and the university.

I decided that I could help bridge this gap and help the students by providing my expertise in applying machine learning to finance and economics. Rather than providing long and lengthy mathematical derivations, I provide the core intuition to many of the popular modelling/machine learning frameworks, and demonstrate these concepts practically in Python on real-life datasets. In that manner, readers of my blog will be able to quickly build the skills required to be a quant or data scientist in the financial industry.

I hope you enjoy exploring Pythonic Finance!

Media Articles

In my capacity as an Honorary Senior Fellow of the UQ Business School, I have written several articles on on topical issues in finance, economics, and banking for the media.

- Should short sales be banned?

- The COVID-19 financial crisis

- Using ETFs in bear markets

- 3 Tips for Introducing Robotic Process Automation.

- ESG Investing.

- The impact of MiFiD II.

- Bitcoin: investment bubble or the future of money?

- Digital Banking and High Net Worth Investors.

- Diversifying your investment portfolio with bonds.

- Can you afford to retire? Expert commentary

- 10 tips to boost your super.

Research

- Dependence Modelling: Copulas, Vine Copulas, Archimedean.

- Tail Risk: VaR, CVaR, Expected Shortfall, Systemic Risk.

- Optimization: Mean-variance, Full-scale, S-curve, Bellman equation.